IRS Non-Filers Identified: What It Means and What to Do If You’re Behind

If you haven’t filed required tax returns, you’re not alone, and the IRS can often see that a return is missing.

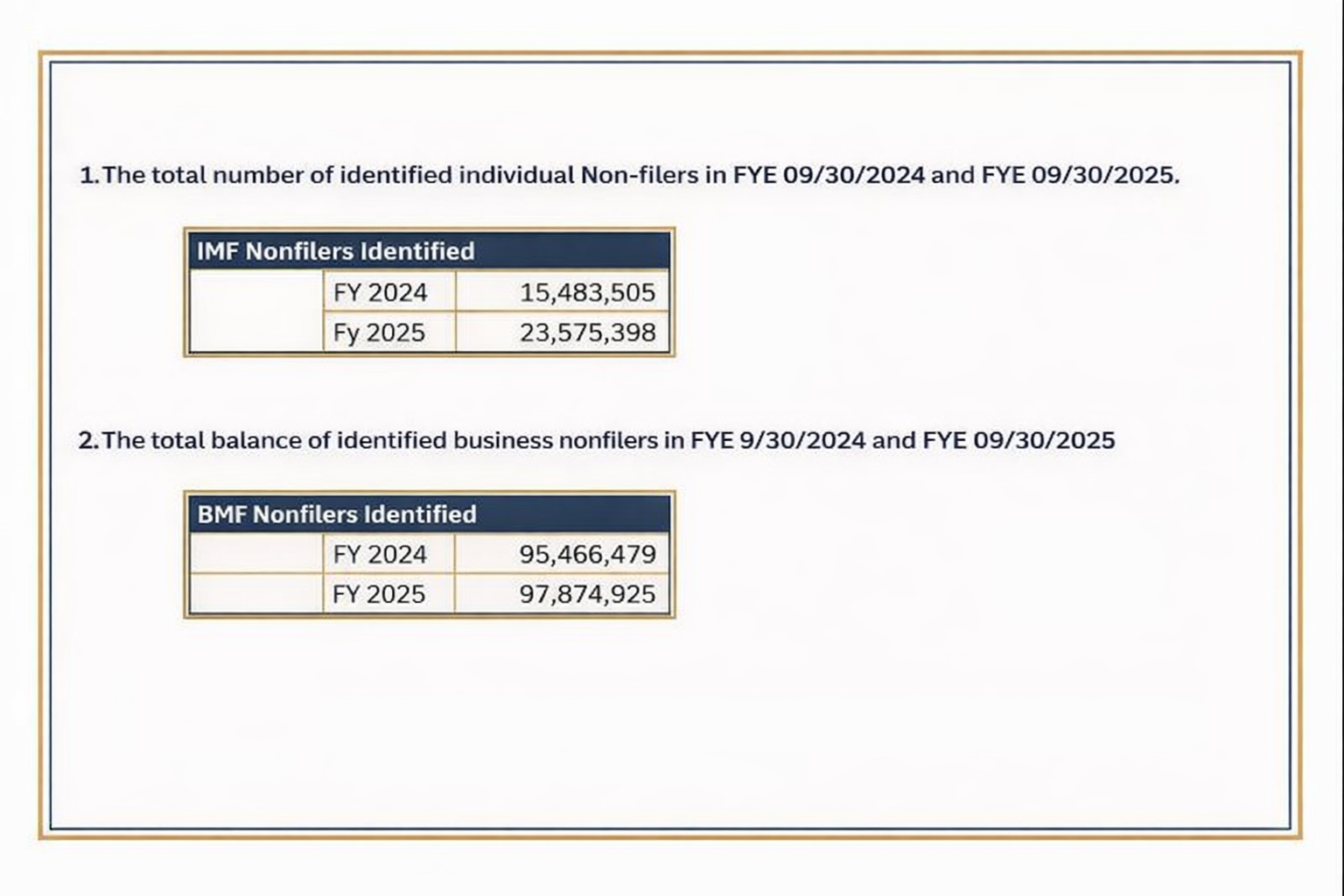

The chart below shows identified non-filers in two IRS categories:

IMF = individuals

BMF = businesses

In plain terms: these numbers reflect taxpayers who likely should be filing returns but haven’t.

Identified non-filers for fiscal years ending 09/30/2024 and 09/30/2025. IMF refers to individual taxpayer accounts; BMF refers to business taxpayer accounts.

What is a “non-filer”?

A non-filer is generally an individual or business the IRS believes has a filing requirement, but the required return(s) are not on file.

Important: non-filing is different from not paying.

Many people avoid filing because they can’t pay. But filing is often the first step to getting back in control.

Common reasons returns go unfiled:

cash flow was tight

records weren’t ready

life or business got messy

fear and avoidance took over

Why non-filing can escalate

When returns aren’t filed, the IRS (and states) may move the account forward in ways that can increase cost and pressure, such as:

Notices requesting missing returns

Substitute for Return (SFR) in some cases (an IRS-filed return that often overstates tax)

Penalties and interest that keep growing

Collection actions once balances are assessed (liens/levies depending on facts)

For businesses, non-filing can become more urgent when payroll-related filing obligations are involved.

What to do if you’re behind (simple plan)

If you’re missing returns, keep it simple:

1) Confirm what’s missing

Identify which years (and which types of returns) are not filed.

2) File correctly—even if you can’t pay

Filing establishes the correct liability and reduces the risk of an SFR. Payment options come after.

3) Choose a resolution you can maintain

Once filings are current (or on track), you can evaluate realistic options based on eligibility.

How Golden Lion Tax Solutions helps

Golden Lion Tax Solutions focuses on tax debt resolution for individuals and businesses. Our approach is built on Trust • Protection • Wisdom, and a simple truth: There is ALWAYS a solution.

We help clients get clear on what’s missing, what’s owed (and why), and what solution is realistic and sustainable without pressure or empty promises. If you don’t need professional representation, we will tell you.

Closing

If you’re behind on filing—individual or business—don’t assume it’s “too far gone.” But the longer non-filing continues, the more expensive and stressful it can become.

There is ALWAYS a solution. The best next step is getting clarity and taking action before enforcement chooses the timeline for you.