IRS LT11 (Letter 1058) Final Notice of Intent to Levy: What It Means and How to Stop a Wage or Bank Levy

An IRS LT11 (Letter 1058) is a final notice before levy action. Learn what it means, what deadlines matter, and the most common ways to stop wage or bank levies.

What Makes a Good Client Referral

A good tax debt referral is a client who’s ready to take action. Use this quick checklist to send a strong, qualified referral for IRS or state tax debt.

IRS Non-Filers Identified: What It Means and What to Do If You’re Behind

IMF (individual) and BMF (business) non-filer counts rose in FY 2024–2025. Learn what “non-filer” means, risks, and next steps.

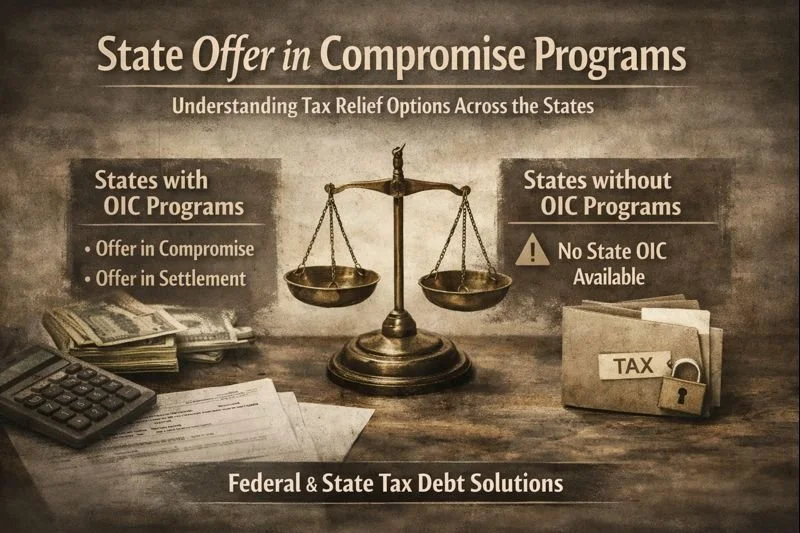

State Offer in Compromise Programs: What Taxpayers and Professionals Should Know

When people hear the phrase “Offer in Compromise,” they usually think of the IRS. What many taxpayers and even some professionals are not aware of is that most states also offer a form of tax settlement or compromise program, though not all states participate and the rules vary significantly.

Everyone Wants an Offer in Compromise But Not Everyone Qualifies

When people start looking for help with tax debt, one question almost always comes up first:

“Can I get an Offer in Compromise?”

Resolving IRS or State Tax Debt without Enlisting an Expert

Many taxpayers do not actually need professional representation. They need clarity, direction and a process they can follow.

A Thanksgiving Message from Golden Lion Tax Solutions

Thanksgiving is a moment that invites both pause and perspective. In the middle of year-end deadlines, holiday plans and the general rush of business life, this season reminds us to look up for a moment and acknowledge the people and progress that carried us through the year.

Trust Fund Recovery Penalty Representation

When a business fails to pay payroll taxes, the IRS can take serious action not just against the business, but against individuals personally responsible for collecting and paying those taxes.

Resolving a Payroll Tax Debt Webinar

At Golden Lion Tax Solutions we have spent years helping taxpayers and tax professionals navigate some of the most stressful moments in their financial lives. One truth always rises to the surface. Clarity brings confidence.

Year-End Moves That Make Tax Debt Easier to Resolve

As the year winds down, most people are focused on wrapping presents, not wrapping up IRS issues. But if you’re facing tax debt, or helping clients who are, this is actually one of the best times to take action.

Employer Shared Responsibility Resolutions

Running a business means taking responsibility for a lot from managing operations and employees to keeping up with complex tax obligations.

State Personal Assessment Representation

Running a business means taking responsibility for a lot from managing operations and employees to keeping up with complex tax obligations.

New Business Formations

Starting a new business is exciting but it also comes with big financial decisions that can affect your future success.

How the IRS Is Operating During the 2025 Government Shutdown

As of October 9, 2025, the government shutdown has entered its second week, and the IRS has begun scaling back operations.

Tax Debt During the Shutdown: What You Must Know

The government is officially shut down. Phone lines are busy. People are confused. Here is the reality you need to know. Your tax debt has not gone anywhere.

Case Study: When $92,000 Turned Into Relief & Restoration

At Golden Lion Tax Solutions, the heart of our work is simple: we stand by people in overwhelming financial situations until the truth is heard and justice is served. Every case is more than numbers on paper it’s someone’s future, peace of mind, and ability to move forward with confidence.

Business Closures

Closing a business is rarely easy, and when outstanding tax liabilities are involved, the process becomes even more complex. At Golden Lion Tax Solutions, we help business owners navigate closures with care and precision so they can move forward without unnecessary personal or financial risk.

Honoring Resilience: A 9/11 Reflection

At Golden Lion Tax Solutions, we pause each year on September 11th to remember the lives lost, the families impacted, and the countless acts of courage that arose on that day in 2001. It is a time to honor the resilience of our nation and the strength of communities who came together in the face of unimaginable tragedy.

The Taxpayer Bill of Rights:What You Need to Know

When you’re dealing with the IRS, it can feel like they hold all the cards. But the truth is… you have rights, and they’re not just guidelines. The IRS has a formal Taxpayer Bill of Rights that lays out the protections you’re entitled to under the law.

Our Promise

When you choose Golden Lion Tax Solutions to help you find the right tax debt solution to meet your needs, we will become your advocate. We promise to find the best solution; it may not be the easiest solution, but it will be the right one for your situation.